Contents

Also you see side-by-side inside days here, when the followed trading period range totally lays inside the range of previous one. It tells you that market is building energy and we should be aware of a strong move in one or the other direction sooner rather than later. That has happened – after couple of weeks you’ve seen that the engulfing pattern has held and the market has shown a strong thrust bar to the upside.

- The main way traders set profit goals using head and shoulders patterns is to project the distance between the neckline and the head from the neckline.

- When the price falls listed below the neckline, the pattern is considered total and the price is likely to continue moving lower.

- Such patterns are thought to arise because of mass psychology acting in the marketplace and then being reflected in the exchange rates of currency pairs.

- This can often lead to stop-losses being triggered prematurely.

- If the market is in an uptrend, you would look for head and shoulders patterns that form at the end of a downtrend.

- Notice in the sketch above, there is an initial bullish trend .

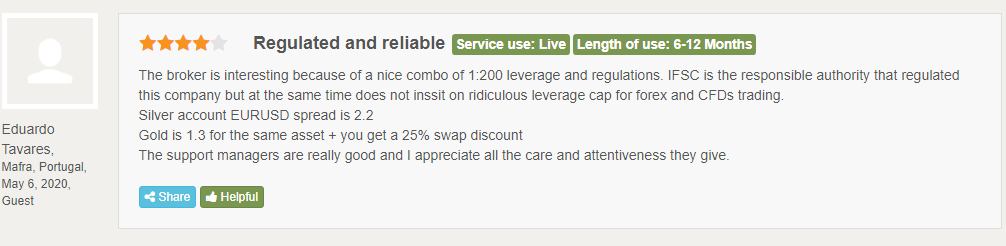

Doji candlesticks are another common pattern all traders should be able to identify in order to apply effective technical analysis to their trades. Moreover, you should be more cautious in setting the take profit level by considering the near-term etoro broker review support and resistance levels. In the example below, we can see how the price broke below the neckline and retested it again to create a trading opportunity. Moreover, this image refers to how to set the stop loss and take profit levels.

Is Head And Shoulders Pattern A Bullish Or Bearish Pattern?

The size should match the distance between the head and the neck as shown on the image. After you measure the size, you simply add it downwards from the point of the breakout. When the price reaches the minimum target, it is an opportune time to close out the trade in full, or at least a sizable portion of it. The charts below shows typical example of a head and shoulders as well as the inverted head and shoulders pattern including how they are traded. As you can see from our chart, the stop is placed just above the last swing high . This is still about 43 pips from my entry, so there is always more room for the market to breathe, but it isn’t so far away to adversely impact my potential reward.

As a trader, it is very important to initiate a trade AFTER confirmation. Ideally, you would want to wait until the price action goes below the neckline after the right shoulder is formed. Typically, when the price breaks the neckline, there will be a surge downward and a bounce back to the neckline. The most common entry point is when the price breaks out of the neckline. This can be said the same on the inverse head and shoulders pattern. The short answer is yes, the head and shoulders chart pattern works.

Furthermore, it gives clean rules and guidelines for take profit and stop-loss levels. The ‘head and shoulders’ pattern is one of many recognizable and tradable chart patterns. In forex jargon, they are known as “shampoo” because of the shampoo brand of the same name.

Tips in Dealing With Head and Shoulders in Forex

It is important to note that this line could be horizontal, or it could be inclined if the H&S chart pattern is inclined itself. Also, it is possible for the neckline to be declined, but that is less common. Regardless, it makes no difference whether the pattern has a straight, inclined, or declined neckline, as long as the price action follows the Head and Shoulders pattern rules.

Prudent traders will stop their trade outs when a failure happens — even if it means taking a loss. Head and shoulders patterns are tradable, supplying chances for entry, stop loss, and earnings targets. To do this, pattern recognition software application can be useful for identifying head and shoulders patterns on charts. When trading the head and shoulders pattern, traders should bear in mind that there are instances where the head and shoulders pattern can also act as a continuation pattern. These continuation patterns though are a lot rare compared to the classic patterns that we usually get to see.

Applying the Head and Shoulders pattern

Volume should then fall overall until rising again during the right shoulder’s decline that ultimately leads to the neckline’s break to the downside. Observing this sort of volume pattern helps confirm that a valid head and shoulders pattern exists that can present a profitable trading opportunity. broker finexo Another fine point to keep in mind when using the head and shoulders pattern is that certain shifts in trading volume tend to accompany the different parts or legs of a valid pattern. The entry chance on a head and shoulders pattern takes place when the cost breaks the neckline.

It contains everything you need to know to maximize profits and minimize losses while trading them. That includes how to enter, where to place your stop loss, measured objectives and much more. If you find a head and shoulders where the neckline moves from exness broker reviews the top left to the bottom right, you may want to stay on the sidelines. It can only be a bearish reversal pattern if it forms after an extended move higher. The first and more conservative approach is to book profit at the firstkey support level.

Another way to calculate the profit target is to choose an exit point based on the market structure. This requires more experience as you need to be able to estimate how far the new trend might travel and where it might change direction. The process is more complicated for stock traders because before they can short a stock, they must borrow it from their broker. The borrowed stock is then sold on the market and later repurchased in order to return it to the broker.

What Is A Head And Shoulders Pattern in The Forex Market?

Thus, it is not surprising that fortunes were made and lost throughout the history of the markets by trying to predict the reversal. Of course, waiting for a neckline break doesn’t eliminate this possibility entirely but when it happens, a new trend is confirmed as the market will inevitably put in a lower low. In this scenario you should be moving forward on high alert even though the likelihood of a reversal is uncertain. The trend may be entering a sideways movement and then surpass its previous high and continue forward. In this lesson, we’ll stick to talking about trend reversals and leave the topic of dandruff for another time. Point 5 makes a lower high which is lower than points 3 and 1 and this forms the “right shoulder”.

The appearance of a head and shoulders is not at first bullish or bearish up until there is a breakout. An inverse bottoming pattern might form, but until the rate breaks above the neck line and keeps moving higher, the price might still be in a drop. If the rate breaks listed below the pattern, that signals an extension of the drop, not a reversal.

Technical analysis is a good way to understand the direction of the market. The Head and Shoulder strategy is designed to help traders identify this reversal and pick good entry points to short trade or long trade. So in essence, a head and shoulders pattern will appear if the market is about to reverse trends. The price of a financial asset, such as a currency pair, is important in trading since it determines whether a trader makes a profit or loses money. The setup is frequently regarded as the most reliable of all major reversal patterns.

That way you can easily spot the most favorable head and shoulders to trade. Today I’m going to show you step-by-step how to trade the head and shoulders pattern. There are a few things that you can do to increase your chances of success when trading head and shoulders patterns in Forex. There are a few things you need to look for when trying to identify the head and shoulders pattern in the Forex market. The forex market is one of the biggest financial markets in the world with trade volumes of over $6 trillion.

Forex Head and Shoulders Patterns Strategy FAQs

Once you have found all three points, you can draw your neckline. This will be a line connecting the highs of the left shoulder and the right shoulder. The pattern is created when there is a peak , followed by a lower high , and then another lower high .